Saturday, December 14, 2013

Tuesday, December 03, 2013

VIX UPDATE

VIX Retest of 1240-1199 head fake provided support to reverse back through 4 week highs, breaking out and squeezing shorts after the attempted breakdown at 1199. Taking this 1463-1199 range, gives an upside expansion target of 1674. Pullbacks within 1330-1290 new support.

RISK DISCLOSURE: PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE RISK OF LOSS IN TRADING FUTURES AND OPTIONS IS SUBSTANTIAL AND SUCH INVESTING IS NOT SUITABLE FOR ALL INVESTORS. AN INVESTOR COULD LOSE MORE THAN THE INITIAL INVESTMENT.

Labels:

VIX,

Volatility

Sunday, November 24, 2013

Wednesday, November 20, 2013

VIX HEADFAKE

VIX broke its trend line from the March lows on Friday, falling below 1240 and hitting 1199. This quickly recovered on Monday as the VIX traded back above this trend line, creating a headfake. Thus far, this head fake has led to a squeeze back to retesting 2 week resistance at 1400. Pullbacks down to 1240 now offer new support based off this 1199 low and a weekly close above 1340 is bullish. Earlier this week, SPY Implied Volatility was 10.16% vs Historical Volatility of 11.73%, according to a 30day average from IVolatility.com.

RISK DISCLOSURE:

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE RISK OF LOSS IN

TRADING FUTURES AND OPTIONS IS SUBSTANTIAL AND SUCH INVESTING IS NOT SUITABLE

FOR ALL INVESTORS. AN INVESTOR COULD LOSE MORE THAN THE INITIAL

INVESTMENT.

Labels:

VIX

Tuesday, November 19, 2013

Sunday, November 10, 2013

SP500 / DOW WEEKLY CHARTS

RISK DISCLOSURE: PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE RISK OF LOSS IN TRADING FUTURES AND OPTIONS IS SUBSTANTIAL AND SUCH INVESTING IS NOT SUITABLE FOR ALL INVESTORS. AN INVESTOR COULD LOSE MORE THAN THE INITIAL INVESTMENT.

Labels:

ANDREW PITCHFORK,

Dow Jones,

sp500

Saturday, November 09, 2013

Thursday, November 07, 2013

The Twitter Top or How the market tanked to celebrate the $25B Twitter IPO

Happy Birthday TWTR!!

Disclosure: I have no position in TWTR, but I wish I had a million shares short from $48 today, holding for $10.

Sunday, November 03, 2013

Saturday, November 02, 2013

Saturday, October 26, 2013

Saturday Rock Blog: Alameda, Rose Parade & Miss Misery (Elliot Smith)

On the tenth anniversary of Elliot Smith's death I think its clear that his music stands the test of time. "...and a little more than five years after [his performance at the Oscar's], on October 21, 2003, he would be dead, at age 34. But the heart of Elliott's music still goes on, a decade later." Read more.

Labels:

Elliot Smith,

Rock Blog

Thursday, October 24, 2013

Sunday, October 20, 2013

Sunday, October 13, 2013

Sunday Rock Blog: Frankenstein (financial sector ETF: XLF)

Disclosure: I have no position in XLF, but it looks like an amazing short on this retrace. The upsloping neckline is ~$19.75, but things should really get interesting on a break of $19.27. The target on a break is $17.69.

Labels:

Bearish,

Edgar Winter Group,

Halloween,

Head and Shoulders,

Retrace,

XLF

Tuesday, October 08, 2013

Saturday, October 05, 2013

Saturday Rock Blog: Put Your Head on My Shoulder (CVX Top)

Disclosure: I sold my October CVX puts Friday and bought calls for a short term pop. Next week I'll look for good entries on CVX November puts targeting the $104-$108 range. So full disclosure, I own CVX calls.

Labels:

Bearish,

CVX,

Head and Shoulders,

Paul Anka

Tuesday, October 01, 2013

Definition of a massive market bubble (created by Bernanke) : Stocks surge to new highs after government shuts down

Bernanke is creating the oh so perfect situation for a full scale US economic collapse, gotta love it. Push on the gas peddle until something spectacular happens helicopter Ben! He will go down as the biggest villains in US history, but for now everyone drink the kool-aid and play the game of musical chairs!

Labels:

Bubble,

Bulls,

Capitulation,

IWM,

Parabola

Monday, September 30, 2013

Sunday, September 29, 2013

Wednesday, September 25, 2013

Saturday, September 07, 2013

Wednesday, August 28, 2013

DIA Chart (bouncing soon)

Disclosure: I have no position in DIA but am looking for it to bounce significantly soon, perhaps at $146.

Labels:

50 dma bounce,

Channel,

DIA

Monday, August 26, 2013

Friday, July 26, 2013

Saturday, July 06, 2013

Saturday, June 29, 2013

Saturday, June 22, 2013

Monday, June 17, 2013

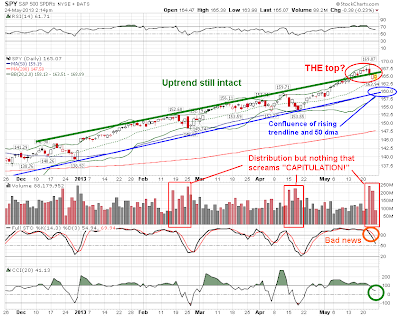

Big Wave Riding or How the S&P 500 looks like its about to tank or Monday Night FOMC-Week Rock Blog

With the recent rapid rise in interest rates, a surging yen, plunging global equities, new bear market in gold, and spiking VIX, many investors seems to be scratching their heads at the modest ~5% correction in US stocks ($169 to $160). If the world is going through a significant deflationary correction (like every index except for US stocks suggests), then why haven't stocks dropped more? Its anybody's guess and there are many things to point to such as the accommodating FOMC (no tapering!), improving US economy, or possibility of fiscal stimulus.

Its anybody's guess and there are many things to point to such as the accommodating FOMC (no tapering!), improving US economy, or possibility of fiscal stimulus. Frankly, I think it could be just a question of leading indicators vs lagging indicators, and the US stock indexes seem to be the latter case these days (a lagging indicator). US stock investor shave grown complacent due to the Bernanke put, and have absolutely no fear of a meaningful correction. That could all be changing right under the bull's noses, if you put all of the puzzle pieces together. Lets keep it simple, based on the above SPY chart I would be looking for shorts anywhere $162 to $165. If SPY can break ~$166 then the bulls could squeeze us up to new highs. However, I think a break of $162-ish spells doom for the bulls with ~$153-$156 (5%-7% lower) targeted by the rising 200 dma and measure rule ($169 - $160 = A, $160- $165 = B).

Probably what will happen is a huge move one day this week related to the FOMC. Either the market will go into some sort of panic and tank, or the bears will capitulate and send stocks into an upwards crash/capitulation, such as I've spoken of recently. I also wouldn't be surprised to see some sort of huge fake out, for example, a spike to new highs followed by a drop below $162 in the same day. If you start to see the volume spike then you'll know the big wave is upon is.

Disclosure: I have no SPY position but I have many other shorts, including S&P500-correlated indexes like the Russel 2000 and the Dow Jones Industrials. I am long the yen and short gold. So I am short, and I intend to stay short unless we break recent highs. If we slide through recent lows it'll be time to hang ten.

Saturday, June 08, 2013

Wednesday, June 05, 2013

Tuesday, June 04, 2013

Broken Link

Looks like LNKD could head to ~$125 so long as it holds below ~$165. I have no position but puts are tempting.

Labels:

Capitulation,

Head and Shoulders,

LNKD

Monday, June 03, 2013

Nothing But Tears (Coming for JNJ)

There are many extremely interesting charts right now. We've are in the midst of one of the longest winning streaks (base don various metrics) in decades for US stocks and this has lead to some really nice formations. Over the next few days I'm going to post some breathtaking charts. I think we are really close to a major turning point (based on bonds, yen, topping patterns, etc) but will we crash up in a capitulative top or has it happened already? Regardless, I am convinced the price action will be fascinating. I am going to update the blog later this week (long overdue), but first, enjoy some sweet charts. JNJ is one that has many people puzzled, the stock had been soaring until the recent correction which looks very healthy by most standards. If it weren't for the fact that we aren't having a baby boom right now, if the steep uptrend hadn't broken, if that beautiful inverted hammer candle hadnt formed at a new all time high, and if the CCI and stochastics weren't flashing bearish signals, I might be bullish on this 50 dma bounce. Instead, I'd look to get puts when the stock reaches the 87.50-88 area. I have no position currently. To quote the words of our former dear leader, "this sucker might go down".

Labels:

50 dma bounce,

Bearish,

Bullish,

Capitulation,

JNJ

Sunday, June 02, 2013

Friday, May 31, 2013

Friday, May 24, 2013

Friday Rock Blog: Jane Says

As you can see from the above, I see the potential for this past week's high to be a major top. Some aspects of the recent price action look like capitulation but neither the volume nor the severity of the decline have me convinced. I have come around to thinking that the only way this five year bull market ends is with a capitulation event where price and volume spike, then reverse. Upward breakouts from rising wedges (see weekly below) usually end in tears, but we still have a few more months till the wedge apex. If this is capitulation, then it feels more like the beginnings of it rather than the end. More and more people are talking about the stock market these days, and it seems like the public is getting in now, finally... 1000 points later (150%). I have longs and shorts but I'm long SPY aggressively long via calls right now.

Disclosure: I own SPY calls

Labels:

Bull Market,

Capitulation,

Jane's Addiction,

Rock Blog,

SPY

Saturday, May 18, 2013

Saturday, May 11, 2013

Saturday, May 04, 2013

Friday, May 03, 2013

The S&P breaks 1600!!!

Labels:

Breakout,

Bull Market,

Bullish,

Capitulation,

Failed Breakout,

SPX,

SPY

Thursday, May 02, 2013

Saturday, April 27, 2013

Saturday, April 20, 2013

Monday, April 15, 2013

The Russell 2000 (small caps) broke hard today

In today's lovely daily candlestick, IWM broke through two seemingly important price points and more importantly its flattening 50 dma. The small cap ETF did all of this on 100M shares traded, second only to the first trading day of the year (~3x avg vol). This now brings into focus previous a previous area of support around ~$89, then nothing but air for another -$4.

Disclosure: I own TWM (inverse IWM)

Labels:

Failed Breakout,

Hammer Reversal,

Harry Belafonte,

IWM,

Russell 2000,

TWM

Sunday, April 14, 2013

FSLR 1 yr chart (+possible support levels)

Disclosure: I am long FSLR and short $40-strike June calls against the entire position. The calls make me nervous, because I think FSLR is in the early stages of a long term uptrend which started almost a year ago. That being said, the bulls would do well to consolidate their (massive) gains of late, but not to beyond recent levels of resistance (i.e. build support above $30). So I'd like to see FSLR hang out here or drift lower to these levels ($33.3-35.6) for a few weeks at least (i.e. form a bull flag and wait for MA's to catch up). Plus, hedging against a broad market decline seems prudent given the circumstances.

Saturday, April 13, 2013

Wednesday, April 10, 2013

Sunday, March 24, 2013

Sunday Rock Blog: Satellite (IWM)

As sort of an update to this post, IWM (above) has been push higher consistently for about four months but recently consolidating some of those gains over the past few weeks. The CCI and stochastics look a lot like they did back in November, right before we broke out and made new all time highs. The trend is up on all time frames here so you have to give the bulls the benefit of the doubt. However, its interesting to note that we never tested that $84 support after the gap n run to start the year. Also, the steeper uptrend that started the year ended in late February, and we have been trying to get back up to it ever since. I am becoming increasingly skeptical of the recent gains and have increased bearish bets on IWM.

Disclosure: I own TWM and IWM calls.

Labels:

Bullish,

Cup n' Handle,

IWM,

Russell 2000

Wednesday, March 20, 2013

Sunday, March 17, 2013

Thursday, March 14, 2013

Subscribe to:

Posts (Atom)

++9_17_2012+-+11_20_2013.jpg)

++Week+42_2007+-+Week+18_2013b.jpg)

++Week+40_2004+-+Week+18_2013b.jpg)