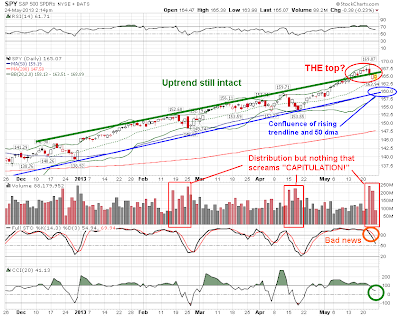

As you can see from the above, I see the potential for this past week's high to be a major top. Some aspects of the recent price action look like capitulation but neither the volume nor the severity of the decline have me convinced. I have come around to thinking that the only way this five year bull market ends is with a capitulation event where price and volume spike, then reverse. Upward breakouts from rising wedges (see weekly below) usually end in tears, but we still have a few more months till the wedge apex. If this is capitulation, then it feels more like the beginnings of it rather than the end. More and more people are talking about the stock market these days, and it seems like the public is getting in now, finally... 1000 points later (150%). I have longs and shorts but I'm long SPY aggressively long via calls right now.

Disclosure: I own SPY calls

1 comment:

since this thing broke out of the wedge to the upside, then the wedge is finished. Doesn't matter when the wedge comes to an end. It's over.

Post a Comment