Driving this slide were concerns over the companys ability to pay down the debt load it took on in order to finance the takeover of a competitor, the Hollywood chain of video rental outlets. In fact, by early this year there were serious fears in the market of bankruptcy, while the company continued to under-perform financially.

In the mean time management has gotten religious about cost controls and the stock price situation turned around with the release of first quarter 2006 earnings on May 11. Let's take a closer look.

Basher types trained in technical analysis (fortunately, there aren't many of them) will see a glaring gap in the daily chart that will most certainly be filled and we must be prepared for that. In comparing the weekly and daily I see a penant that touched the upper BB on Friday, on both charts strangely enough. Resistance could be provided by the 200dma that is just entering the picture on the daily chart, at $6.48. Confirmation to that resistance level is shown by the Price by Volume overlay in the weekly chart. There is a second large group of bagholders at this level who must be satisfied before we go forward. However, I believe we are looking at blue-sky time after that.

How long will this take? Well, I don't know. But I believe we'll see a resolution to this whole situation with the second quarter earnings which should be presented sometime in August.

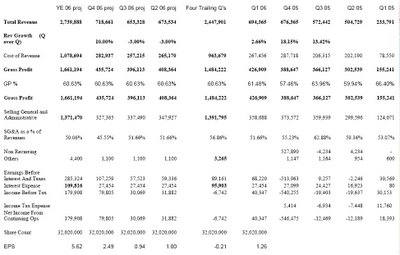

In terms of fundamentals and projections, I took the time to put together a spreadsheet.

1 comment:

Three cheers for Indigo! His timimg was perfect on the post about MOVI as it broke out today. It punched right through some seemingly important resistance areas into "blue sky" territory. And once it got there is ran depite the collapsing broader market around it. There wasn't much of a gap either, so if you heeded his advice and bought the open you would have held the NASDAQ's fourth biggest gainer (although it was number one for much of the day) up $1.01 or about 18%. There were buyout rumors circulating with Blockbuster, Netflix and Amazon as suggested suitors. But I think it was indi's post that got this baby MOVIn' today.

http://www.marketwatch.com/News/Story/Story.aspx?guid=%7B1A9E0D34%2D5FD7%2D4DDD%2DB8A5%2DA96BF72FC646%7D&source=blq%2Fyhoo&dist=yhoo&siteid=yhoo

"Analysts, meanwhile, were scrambling to figure out why there was a sudden movement in Movie Gallery shares."

Maybe they should have asked indigo-alien.

Post a Comment