"The investment seeks daily investment results, before fees and expenses, which correspond to the inverse of the daily performance of the NASDAQ-100 index. The fund normally invests 80% of assets to financial instruments with economic characteristics that should be inverse to those of the index. It may employ leveraged investment techniques in seeking its investment objective."

While it doesn't explicitly say this above, the "Ultra" funds are supposed to return twice the return of the underlying investment. For example, if the Q's (nasdaq 1000 etf QQQQ) drops 1% then the UltraShort "QID" should go up 2%. If you look at a comparison between the two you can see that QID gets close but doesn't actually move quite that much. It looks more like 1.7x the inverse of QQQQ:

The idea is that investors can quickly and simply get short exposure in a way that moves faster than the broad market QQQQ. In some cases an investor might not have access to short selling, in an IRA account for example, so they can just buy QID instead.

The idea is that investors can quickly and simply get short exposure in a way that moves faster than the broad market QQQQ. In some cases an investor might not have access to short selling, in an IRA account for example, so they can just buy QID instead.Ok, what if you are crazy bearish and you want to make the most money possible. You might think that you could get extremely high leverage using options on an already more leveraged QID. In otherwords, you might expect that QID calls would move faster than than the QQQQ puts on a percentage basis. Well, you would be wrong. In fact, it seems like you would have even less leverage among other drawbacks to the idea.

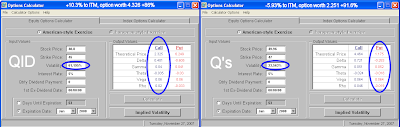

I'll admit, I got excited when I heard about QID options and bought a few calls today. But after closer inspection using this free option calculator provided by the cboe, I realized that the extra volatility is priced into the UltraShort options. The QQQQ have around 30% implied volatility while the QID options have around 60%, so double. In othewords, the options have twice the percentage move priced in to their premium. That translates into roughly the same gain in contract value if the expected move occurs. So if QQQQ goes down 5%, and QID goes up 10% then the equivalent options on both will increase in value roughly 90%.

My results are summarized in the image of the option calculator above. I assumed the move in QQQQ's was about 5% lower and I picked the option that would be at the money after that move, similarly I assumed the move in the QID would be up 10% and picked the contract that would be closest to the money. I also assumed that the implied volatility would remain constant. There are errors in this calculation but the result implies that if QID does not actually move at twice the inverse of the QQQQ then the QID options will actually perform worse. And the thing I hate most about the UltraShort options is that they are very illiquid, there are very large spreads on some of these and the volume is super low. I can tell you that I will be getting out of my QID calls soon to try and replace them with QQQQ puts, its really the way to go.

1 comment:

Thanks for the analysis. I was getting ready to follow you on those QID calls.

Post a Comment